The Institute for Wealth Management was recently featured on page 54 of Wealthmanagement.com’s Market Outlook 2019.

Please feel free to read the entire outlook here – or read the contribution by The Institute for Wealth Management below.

Help Clients Drive Meaningful Results in 2019 through Impact Investing

By Jeff Pietch, CFA

In the usual “Market Outlook,” one may expect predictions about how stocks will perform a year out. Here instead we focus on an accelerating mega-trend that could help build your practice no matter which path markets take, explaining why 2019 is the year to climb aboard. Data indicates that prospects are exponentially making conscious decisions according to how their investments may positively “impact” their environment and community.

Ultimately, impact investors desire the same outcome we all do: potential return on investment. However, these investors also seek to remain true to their values. According to US|SIF, the broad outlines of the environmental, social and governance issues considered by managers who oversee impact portfolios include:

- Environment, including climate change and clean technology.

- Social, like conflict risk, equal opportunity, labor and human rights.

- Governance, like shareholder actions, corporate board and proxy selections.

- Criteria to exclude, such as tobacco, alcohol, firearms and gambling, while including industry best practices.

Why impact investing should be part of your practice in 2019

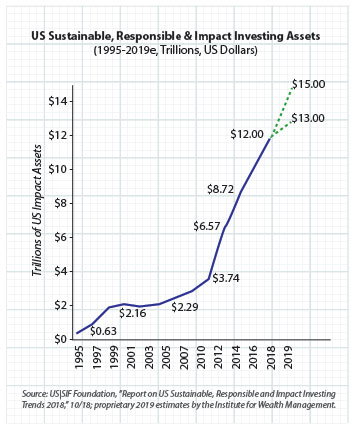

Impact investing represents a growing base. Between 2012 and 2016, the pace of US impact growth was 19%-points higher than traditional assets1. By mid-2018, that supported a $12.0 trillion base, up 38% from 20162. Applying these trends, The Institute for Wealth Management estimates 2019 impact assets could be another $1-3 trillion higher.

It is also estimated that impact investing now captures 1 out of 4 dollars in new US assets, up from 1 of 6 just two years ago2. And yet, overseas investors select impact portfolios at nearly double that rate, demonstrating significant potential.

Further, there is a sizable advisor/prospect disconnect. While 74% of investors seek more information about impact investing, only 6% of advisors indicate interest with only half having such solutions available3. This may represent a significant differentiation opportunity for savvy advisors.

Who is interested in impact investing?

Among individual investors, millennials lead in having a strong interest in impact portfolios at 86%, followed by women at 84%2. Millennials, who stand to inherit $59 trillion by 2060 and are now moving into ranks of active investors, rate impact as a “crucial criterion” when investing. Finally, 84% of institutions are either incorporating or actively considering impact investing. And with valuations increasingly supporting brand intangibles and a recent mid-term election outcome that is arguably impact friendly, the investing rational could well be there to match the trend for 2019.

The bottom-line for impact investing

As the world grows in its awareness of corporate practices and their social and environmental impact, The Institute has kept pace by creating efficient, values-based holdings within its Socially Responsible Investing Portfolios. Although its criteria for selecting appropriate funds can be stringent, The Institute believes that impact investors ultimately desire the same outcome as all investors: potential return on investment. Beyond the necessary screening, impact investors should expect their manager to address risk first and return second, which is precisely The Institute way.

Sources: (1) Morgan Stanley, “The Case for Sustainable Investing”, July 2018; (2) USSIF, “Report on US Sustainable, Responsible and Impact Investing Trends 2018”, October 2018; (3) Allianz Global Investors Study, June 2017. Nothing herein should be construed as investment or tax advice, nor is it a recommendation to buy or sell any securities.

THIS MATERIAL IS FOR INSTITUTIONAL/BROKER-DEALER USE ONLY.