What Advisors Can Expect

You will have one point of contact throughout the entire process. We can match you and your staff with an Institute staff member that best fits your needs and location. You will receive direct access to your client’s wealth management portal. This way you will be able to upload documents, review the progress and make future changes when necessary. You can expect a final deliverable within three business days once all of the relevant data has been received.

Our Process

Our process begins with a conversation with you to determine the best point of contact for the different phases of the financial planning process. We also discuss to what extent you would like us to be involved. Some advisors want us to be a part of the entire process; some prefer a more limited approach. Either way, you will have access for the wealth management portal as an advisor to aid in the discovery phase and review the progress of the Plan.

We begin this stage during our initial meeting where we get to know your client. We focus on what the specific needs are and what they want their investment capital to do for them.

The primary objective of this stage is to develop an affective, long-term investment strategy that is custom tailored to the unique needs of your client. We then develop a comprehensive plan that outlines the strategy we recommend for long-term success.

Once we have Phase I and II completed, we can then deliver the Plan either to you for delivery to the client or for both of us to deliver to the client during a joint meeting using WebEx or other method. The advisor and The Institute will have a call prior to interacting with the client in order to ensure we are all on the same page. Make sure you provide the Plan to your compliance department.

The primary objective of this Phase is for us to help you successfully implement the investment strategy. We will be available to you if the need arises.

We will monitor and adjust the Plan on a reasonable basis based on information that you provide. By doing so, you can ensure that they are staying on track to achieve the goals of the Plan and to make adjustments where necessary.

The Plan

A financial plan can include a variety of reports. Here is a summary of the available reports. The advisor will complete an agreement with The Institute to indicate which of these to include in the Plan.

- Account Information

- Annuities

- Assets

- Balance Sheet

- Business

- Buy/Sell Transactions

- Cash Flow

- Detailed Balance Sheet

- Detailed Estate Calculations

- Detailed Flow Charts

- Disability Insurance

- Education & Expense Goals

- Education Planning

- Estate Calculations

- Estate Distribution

- Estate Liquidity

- Estate Plan Techniques

- Estate Transfer

- Expense Planning

- Fact Details

- Fact Summary

- Flow Charts Tax

- Human Life Value

- Income Tax

- Insurance vs. Investing Comparison

- Investments

- Ledger

- Life Insurance

- Long Term Care Insurance

- Monte Carlo

- Multi-Generational Transfers

- Net Worth

- Objectives

- Portfolio Analysis

- Portfolio Reinvestment

- Protection

- Retirement Planning

- Statements

- Stock Options / Grants

- Supplemental

- Tasks / Notes

- What Ifs

- Worksheets & Schedules

Portfolios

The Institute has relationships with expansive global organizations and top-tier financial institutions; so we constantly have our finger on the pulse of the market through timely reports and trend trackers. What’s more, our team has vast experience in analyzing economic data and comprehending future potential. Which, in turn, helps protect and inform our clients’ investments.

Through our extensive industry insights and unparalleled expertise, we’ve created a series of proprietary models. These models are based on the maximum risk tolerance of any given investor.

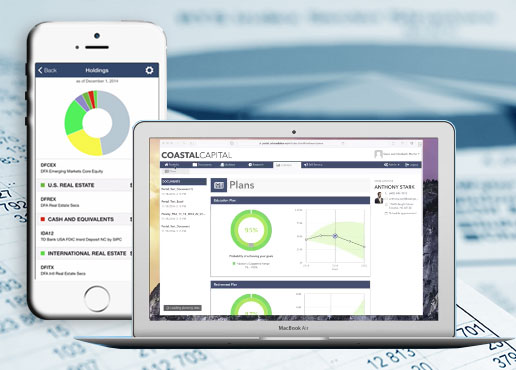

Our Best-in-Class Technology

APPLY TO JOIN OUR TEAM

Phone

303.572.3500 or 877.572.3500

Fax

303.572.3515

The Institute for Wealth Management

Denver Financial Center

1776 Lincoln Street, Suite 950

Denver, Colorado 80203